Who Is Investar?

From Koon posted KC GOH

Posted on October 12

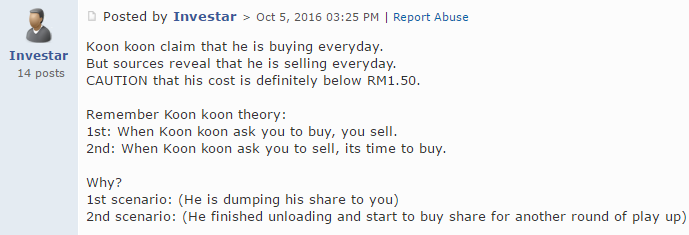

On 7th Oct 2016, I posted an article with the title “My last article on share

investment”in which I stated that I have decided to stop posting anymore

articles on investment to avoid irritations because one stupid idiot called

Investar who posted the following:

investment”in which I stated that I have decided to stop posting anymore

articles on investment to avoid irritations because one stupid idiot called

Investar who posted the following:

My private detective has found out that he is Kueh Shu Tsung and a

copy of his I.C. is attached below.

He also frequently writes senseless comments under the following

pseudonyms

Optimus

timetokoon

Investar

upsidedown119

hansolo2

My advice to Kueh Shu Tsung is that he must really examine his track

record to see why he is still so poor. He is already 48 years old. I was

told that he has lost all his capital and now he is writing nonsense to

let out his frustration.

He must remember that he is born with 2 ears and 1 mouth. He must

always listen more than he talks. He can always learn something if he

listens carefully.

When he is in great difficulty and cannot find a solution, he must

remember that time will cure everything. However good or bad a situation is, it will change.

He must never give up if he wants to achieve his goal.

I am honest and sincere and I always treat people with kindness.

I always help poor people in whatever way I can.